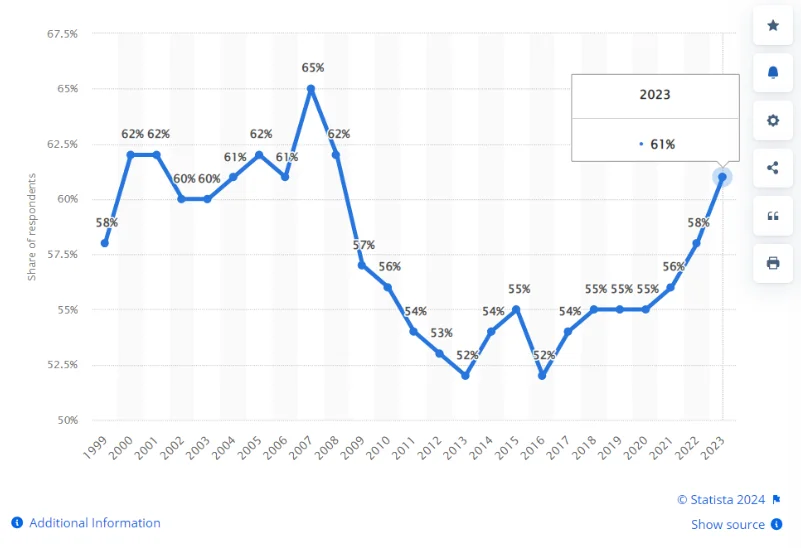

Investing is a powerful tool for achieving financial goals. It isn't just for Wall Street tycoons or Silicon Valley entrepreneurs. In fact, 61 percent of Americans invested in stocks last year to grow their wealth.

(Source: Statista - US adults invested in stocks)

No matter if you're investing for retirement, a house, or just to grow your money, you should know what exactly investing is and why you should care.

Let’s break down the core investing concepts to help you start confidently.

What is Investing?

Investing is the process of using money to buy assets like stocks, bonds, real estate, or mutual funds to increase their value or earn profit or income over time.

Unlike simply saving money, investing involves putting your money to work in various financial instruments, which can grow significantly. But, it also comes with the chance of losing some or all of your investment.

Why is Investing Important?

When you invest, you're giving your money a chance to help you reach your financial dreams sooner and build a more secure future.

Here are a few reasons why investing is so important:

1. Your Money Can Grow Much Faster

When you invest, your money has the potential to grow a lot more than it would in a savings account. For example, the stock market has grown by about 10% per year on average over the long term. That's way more than the tiny interest you'd get from a bank.

2. You Can Stay Ahead of Rising Prices

Inflation erodes the purchasing power of your money over time. The annual inflation rate in the U.S. over the past year has been around 3-5%. Investing gives your money a chance to grow faster than prices. This keeps your buying power up.

3. Your Money Can Make More Money (Compound Growth)

Another good thing about investing is you can get a return on your original investment and returns on those returns, too. As your investments generate returns, those returns can be reinvested to earn additional returns. Over time, this compounding effect can significantly accelerate wealth accumulation. For example, a $10,000 investment earning an 8% annual return would grow to over $100,000 in 30 years through compounding.

4. You Can Spread Your Money Across Different Investments (Diversification)

With investing, you can spread your money across different asset classes, sectors, and geographic regions. This will help protect your money if one investment fails.

5. You Can Reach Your Big Money Goals Faster

Your dreams of owning a house, sending kids to college, or retiring comfortably can be realized with investment quicker than just saving alone.

6. You Might Pay Less in Taxes

Some types of investments come with tax benefits. You can deduct contributions to certain accounts from your taxes now or pay less tax on your investment gains in the future.

For example, contributions to traditional IRAs or 401(k)s can be tax-deductible, while Roth IRAs offer tax-free growth and withdrawals in retirement.

7. You Can Create a Second Source of Income

Some investments, like dividend-paying stocks or rental properties, make regular income. This extra money can be especially helpful in retirement or as a boost to your regular paycheck.

8. You're Building a Financial Safety Net

Growing your money through investing creates a financial cushion for you. This can help you handle unexpected expenses or tough economic times without stress.

How Does Investing Work?

Investing works through three main interconnected processes:

1. Capital Allocation and Ownership

When you invest, you allocate your money to various assets like stocks, bonds, or real estate. This makes you a partial owner of these assets. For example, buying stocks gives you a share of ownership in a company, while purchasing bonds makes you a creditor to the issuing entity.

2. Value Creation and Growth

The entities you've invested in use your capital to generate economic value. A company might expand its operations, develop new products, or improve efficiency. This value creation drives the potential growth of your investment. Over time, your investments can grow in two primary ways:

The market value of your asset increases.

You receive dividends, interest payments, or rental income.

3. Market Dynamics and Risk-Return Tradeoff

The value of your investments fluctuates based on supply and demand in the financial markets. Factors such as economic conditions, company performance, and investor sentiment affect asset prices. This introduces the concept of risk - generally, investments with higher potential returns come with higher risks.

These processes work together continuously. When your investments grow, you can reinvest the returns, which may lead to compound growth over time. With a longer time horizon, the effectiveness of this cycle improves, enabling investments to ride out short-term market volatility and fully reap the benefits of compounding.

Investing Vs. Saving

Savings is putting money aside for short-term goals or emergencies. It typically involves keeping money in low-risk, easily accessible accounts, like Savings Accounts, Certificates of Deposits (CDs), and Money Market Accounts.

As for investing, it involves putting money into assets for a longer period of time, which carries more risk but could bring bigger rewards.

Here are the key differences:

Aspect | Saving | Investing |

Risk | Low | Higher |

Potential Returns | Low | Higher |

Liquidity | High | Varies |

Time Horizon | Short-term | Long-term |

Main Purpose | Emergency funds, short-term goals | Wealth building, long-term goals |

The Fundamentals of Investing: Risk, Return, and Time

Risk, return, and time are the three key concepts behind investing. You need to know these three things in order to build a successful portfolio:

Risk: The Price of Potential Gain

Risk in investing refers to the possibility that an investment's actual return will differ from what you expected. In simpler terms, it's the chance of losing some or all of your money.

Different types of investments carry different levels of risk:

Low-risk investments - These include government bonds, certificates of deposit (CDs), and high-yield savings accounts. They're generally considered safer but offer lower potential returns.

Medium-risk investments - These might include corporate bonds, real estate investment trusts (REITs), and some mutual funds.

High-risk investments - Stocks, especially of smaller or newer companies, cryptocurrencies, and options, fall into this category. They can offer higher potential returns but also come with a greater chance of losing money.

According to Gallup, 61% of Americans own stocks, showing that many are willing to take on some level of risk for potential gains. However, it's crucial to understand your own risk tolerance – how much uncertainty you're comfortable with in your investments.

Your risk tolerance often depends on factors like:

Your age: Younger investors can generally afford to take more risks as they have more time to recover from potential losses.

Your financial goals: Short-term goals might require lower-risk investments, while long-term goals can often withstand more risk.

Your personal comfort level: Some people are naturally more risk-averse than others.

Return: The Reward for Taking Risk

Return is the money you make (or lose) on an investment. It's usually expressed as a percentage of the amount invested.

Returns can come in two forms:

Income: This includes dividends from stocks or interest from bonds.

Capital gains: This is the profit you make when you sell an investment for more than you paid for it.

Time: Your Most Powerful Investing Tool

In investing, time is the most important factor. The longer you keep your money invested, the more opportunities it has to grow through compound returns.

Here's why time matters:

Volatility can be weathered - Even though markets can be unpredictable in the short term, they tend to trend upward over the long term. For example, while the S&P 500 calculator shows negative returns in about 25% of individual years, it has never had a negative return over any 20-year period.

Allows compound returns to work - For example, if you invest $10,000 at a 7% annual return, After 10 years, you'd have about $19,672, and After 30 years, you'd have about $76,123.

Reduces the impact of short-term losses - A study by J.P. Morgan Asset Management found that from 1950 to 2022, the S&P 500 had positive returns in 72% of calendar years.

It allows you to take advantage of dollar-cost averaging - Dollar-cost averaging is a strategy that involves investing a fixed amount regularly, regardless of market conditions. Over time, this can help reduce the impact of market volatility on your investments.

The power of time in investing is why many financial advisors recommend starting to invest as early as possible, especially for long-term goals like retirement.

What are the Main Types of Investments?

When you're just starting to invest, it's good to know that there are many ways to put your money to work. Some people buy stocks, which means owning a small part of a company. Others prefer bonds, which are like loans you give to companies or the government. There are also mutual funds and ETFs, which let you invest in many different stocks or bonds at once.

Some investments, like savings accounts or certificates of deposit, are very safe but usually grow slowly. Others, like real estate or cryptocurrencies, can be riskier but might grow faster.

Each investment type has its pros and cons. You should assess your own goals, how comfortable you are with risk, and how long you plan to keep your money invested before deciding what type is right for you.

Learn more about Common Investment Types.

Investment Accounts: Taxable vs. Tax-advantaged

You'll need to pick the best place to put your money when you're ready to invest. You don't just have to choose stocks and bonds – you also have to decide which type of investment account you want to use. Investing accounts come in two kinds: taxable and tax-advantaged. Here's what we're going to do:

Taxable Accounts

Taxable accounts are what they sound like – accounts where you pay taxes on your investment gains, such as Brokerage Accounts (the most common type of taxable investment accounts). You can open one with a broker (online or in-person) and use it to buy and sell various investments.

Key points about taxable accounts:

You can withdraw money at any time without penalties.

You can put in as much money as you want, whenever you want.

You'll need to pay taxes on your investment gains each year. This includes capital gains when you sell investments for a profit and taxes on dividends or interest you earn.

Losses can be used to offset gains, potentially reducing your tax bill.

You can invest in almost anything - stocks, bonds, mutual funds, ETFs, and more.

Tax-Advantaged Accounts

Tax-advantaged accounts offer special tax benefits. The two main types are:

Traditional Accounts: These include Traditional IRAs and 401(k)s. Contributions are often tax-deductible, reducing your taxable income for the year. Your investments grow tax-free, but you'll pay taxes when you withdraw the money in retirement.

Roth Accounts: These include Roth IRAs and Roth 401(k)s. You contribute after-tax dollars, but your investments grow tax-free, and you pay no taxes when you withdraw the money in retirement.

Both types of tax-advantaged accounts have contribution limits and rules about when you can withdraw money without penalties.

If you invest in a tax-advantaged account, you could boost your after-tax returns by 1% to 2% compared to an ordinary taxable account.

Some common tax-advantaged accounts include:

401(k)s: Employer-sponsored retirement accounts. As of 2024, you can contribute up to $23,000 per year if you're under 50 or $30,500 if you're 50 or older.

Individual Retirement Accounts (IRAs): Personal retirement accounts. For 2024, you can contribute up to $7,000 per year if you're under 50 or $8,000 if you're 50 or older.

529 Plans: Designed for education savings. These grow tax-free, and withdrawals are tax-free if used for qualified education expenses.

Key points about tax-advantaged accounts:

They offer significant tax benefits, potentially allowing your money to grow faster.

They often have restrictions on when and how you can withdraw money.

There are usually annual contribution limits.

Which Should You Choose?

The choice between taxable and tax-advantaged accounts depends on your financial goals and situation. Many financial experts recommend this order of priority:

Contribute enough to your 401(k) to get any employer match.

Max out an IRA (Traditional or Roth, depending on your situation).

Max out your 401(k) if you can.

Use a taxable account for additional investments.

There is no either/or choice here. Many investors use both types of accounts to achieve their goals of tax benefits, flexibility, and long-term growth.

How to Start Investing?

Starting to invest might sound tricky, but it's easier than you might think. You don't need to be a Wall Street whiz or have a ton of cash. In fact, many people start with just a few dollars. The key is to begin with what you have and learn as you go.

Successful investing lies in understanding your financial situation, setting clear goals, and choosing investment options that align with your risk tolerance and time horizon. No matter what your investing goals are, whether you want to save for retirement, buy a house, or increase your wealth, there is an investment strategy that can help.

These days, you can start investing right from your phone. There are apps and websites that make it super easy to buy stocks, bonds, or funds. Some even let you start with just $1.

Remember, investing isn't about getting rich quickly. It's more like a marathon than a sprint. The most successful investors often are the ones who stick with it over time.

For step-by-step instructions and tips on how to start investing, check out our full guide.

Wrapping Up

Now you've got the basics of investing under your belt. With this information, you can start making your money grow and reach your financial goals.

Remember, everyone starts somewhere. As you move forward, keep learning, and don't be afraid to ask questions. If things get tricky or your financial situation changes a lot, that might be the time to chat with a financial advisor.

Ready for more? Stay tuned for more investing tips and tricks!